3 Proven ABM Expansion Tactics to Grow Customer Revenue

Your best customers aren’t just revenue sources. They’re untapped goldmines waiting for strategic expansion. While most B2B companies obsess over acquiring new accounts, the smartest growth leaders are doubling down on the accounts they already know, trust, and understand. The payoff? ABM drives a 171% increase in average annual contract value (ACV) among programs that target existing customers.

This isn’t just about sending a few upsell emails or scheduling quarterly business reviews. True ABM expansion requires treating your existing accounts like the high-value prospects they are. With personalized messaging, coordinated touchpoints across multiple stakeholders, and data-driven strategies that identify the right expansion opportunities at precisely the right moment.

The landscape has fundamentally shifted. 75% of marketers now use ABM specifically for customer marketing (retention and expansion), up from 38% in 2020. This massive adoption surge signals that customer expansion through ABM isn’t experimental anymore. It’s become essential for sustainable growth in increasingly competitive markets.

Key Takeaways

- ABM expansion drives 171% higher average annual contract value compared to traditional upselling approaches by treating existing customers like high-value prospects with personalized, multi-stakeholder campaigns rather than generic product-focused outreach

- Choose the right ABM approach based on expansion potential: Use 1-to-1 ABM for enterprise accounts with $500K+ expansion potential, 1-to-Few for mid-market segments, and 1-to-Many for programmatic scaling across larger account sets

- Focus on new stakeholder identification beyond existing contacts since true account expansion requires engaging decision-makers who weren’t involved in the original purchase, such as procurement, operations, or C-suite executives with different priorities

- Measure engagement depth over lead volume by tracking account-specific metrics like stakeholder meeting acceptance rates, content consumption patterns, and pipeline quality rather than traditional demand generation metrics

- Ensure sales and marketing alignment on expansion strategy to prevent campaign failures when marketing generates new stakeholder engagement but sales teams aren’t prepared for expansion conversations with appropriate messaging

TABLE OF CONTENTS:

Why ABM Expansion Outperforms Traditional Upselling

Traditional upsell approaches treat customer growth as a numbers game: blast everyone with the same offer and hope for the best. ABM expansion flips this model entirely, focusing on account intelligence, stakeholder mapping, and personalized value propositions that speak directly to each decision-maker’s priorities.

The difference shows up immediately in pipeline quality. 65% of companies with ABM programs report an increase in pipeline opportunities and/or opportunity quality. When you’re targeting existing customers who already trust your brand, this pipeline quality improvement translates directly into higher close rates and faster deal velocity.

Consider the fundamental advantages of focusing expansion efforts on existing accounts rather than chasing net-new prospects. Your current customers already understand your value proposition, have established buying processes, and possess historical data you can leverage for targeting. Most importantly, they’ve already overcome the initial trust barrier that often stalls new prospect conversations.

“ABM expansion isn’t about selling more to the same people. It’s about identifying new stakeholders, departments, and use cases within accounts that already know and trust your solution.”

Strategic Approaches to ABM Account Expansion

Successful ABM expansion operates across three distinct strategic dimensions, each requiring different resources, timelines, and measurement approaches. Understanding these options helps you match your expansion strategy to your available resources and account potential.

| ABM Approach | Target Scope | Personalization Level | Resource Investment | Best Use Case |

|---|---|---|---|---|

| 1-to-1 ABM | 5-10 strategic accounts | Hyper-personalized | High | Enterprise accounts |

| 1-to-Few ABM | 20-50 similar accounts | Segment-specific | Medium | Mid-market accounts |

| 1-to-Many ABM | 100+ accounts | Programmatic personalization | Lower | SMB accounts |

The 1-to-1 approach works exceptionally well for enterprise account expansion where individual deals can justify significant resource investment. Here, you’re creating bespoke campaigns for each account, including custom content assets, personalized event experiences, and direct executive engagement. Think custom ROI calculators built specifically for their industry, personalized video messages from your C-suite, or exclusive roundtable events featuring their exact peer group.

For mid-market expansion, the 1-to-Few model delivers optimal efficiency by grouping similar accounts facing comparable challenges. You might cluster healthcare clients launching digital transformation initiatives, or manufacturing companies dealing with supply chain optimization. This approach allows you to create segment-specific messaging while maintaining cost efficiency.

The 1-to-Many approach leverages marketing automation and AI-powered personalization to scale expansion efforts across larger account sets. This programmatic ABM strategy uses dynamic content, behavioral triggers, and predictive analytics to deliver relevant messaging at scale.

Building Your ABM Expansion Framework

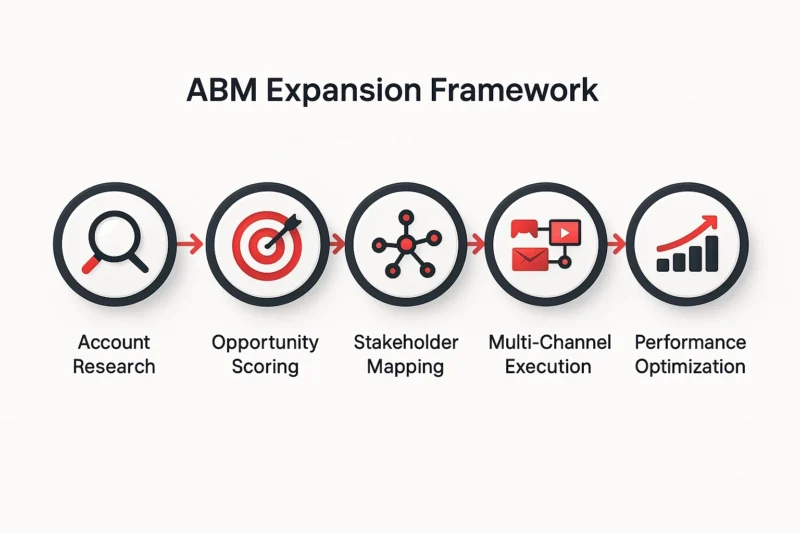

Effective ABM expansion requires a systematic framework that identifies opportunities, prioritizes accounts, and executes coordinated campaigns across multiple touchpoints. The most successful teams follow a structured approach that balances data-driven insights with human relationship intelligence.

Start with comprehensive account intelligence gathering. This goes far beyond your CRM data to include external signals like hiring patterns, funding announcements, technology stack changes, and competitive intelligence. Tools like intent data platforms can reveal when your existing customers are researching adjacent solutions or expanded use cases.

Account scoring becomes critical for prioritization. Develop a framework that weighs expansion potential (contract size, available departments, growth trajectory) against engagement indicators (recent activity, stakeholder changes, usage patterns). The highest-scoring accounts receive your most intensive 1-to-1 treatment, while others flow into appropriate segment-based campaigns.

Stakeholder mapping distinguishes ABM expansion from traditional customer marketing. Your original buyer might have been in IT, but expansion opportunities often require engaging procurement, operations, or C-suite executives. Each stakeholder group needs tailored messaging that addresses their specific priorities and concerns.

Campaign execution requires orchestration across multiple channels and touchpoints. Your expansion campaigns might include personalized LinkedIn ads targeting specific job titles within target accounts, custom email sequences triggered by behavioral data, direct mail packages tied to digital campaigns, and coordinated sales outreach timed to marketing touchpoints.

The key differentiator in ABM expansion is message coordination across all touchpoints. Whether a prospect sees your LinkedIn ad, receives your email, or takes a sales call, they should encounter consistent value propositions and calls-to-action that reinforce your expansion narrative.

Measuring ABM Expansion Success

ABM expansion requires different metrics than traditional demand generation campaigns. While lead volume and cost-per-lead matter less, engagement depth, pipeline velocity, and revenue attribution become critical success indicators.

Account engagement metrics provide early indicators of expansion potential. Track metrics like email engagement rates by stakeholder type, website session depth for target accounts, content consumption patterns, and social media interactions. Rising engagement often precedes expansion opportunities by several months.

Pipeline metrics focus on quality over quantity. Measure meeting acceptance rates with new stakeholders, proposal request rates from expansion campaigns, and average deal size for expansion opportunities versus initial sales. These metrics help optimize your approach and justify continued investment.

Revenue attribution connects your ABM expansion efforts directly to business outcomes. Track influenced pipeline, closed-won revenue from expansion campaigns, and customer lifetime value improvements. Advanced attribution models can even account for the long sales cycles typical in B2B expansion deals.

Real-World ABM Expansion Success Stories

The most compelling evidence for ABM expansion comes from companies that have transformed their growth trajectory by focusing systematically on existing accounts. These success stories reveal common patterns and strategies that can be adapted across industries and company sizes.

HealthLink Dimensions, a healthcare data and marketing services company, faced the challenge of deepening penetration within existing health-insurance accounts while generating net-new contacts for upsell and cross-sell opportunities. Their traditional approach lacked scalability for engaging multiple decision-makers within complex healthcare organizations.

Working with agency partner Acclaro, HealthLink implemented a comprehensive ABM program that profiled ideal personas across their existing accounts, created personalized content journeys for each stakeholder type, and orchestrated multi-channel outreach campaigns. The results were dramatic: a 234% increase in new-customer pipeline tied to identified upsell and cross-sell opportunities.

The key insight from HealthLink’s success was the importance of precise persona mapping within existing accounts. Rather than treating each account as a monolithic entity, they identified distinct stakeholder groups with different priorities, communication preferences, and decision-making authority. This granular approach enabled highly relevant messaging that resonated with each group.

In the SaaS sector, Personify wanted to unlock higher engagement and account intelligence within their top-tier customer base to drive upsell and cross-sell opportunities. They implemented a full-funnel ABM programme that defined ideal customer profiles, segmented accounts by lifecycle stage, and ran persona-based advertising campaigns with tailored nurture tracks.

Their lifecycle-based ABM approach generated a 39× increase in engaged website visitors from target accounts over 11 months, dramatically expanding their pipeline for cross-sell and renewal growth. This case demonstrates the power of behavioral segmentation in ABM expansion. Treating customers differently based on their current usage patterns and lifecycle stage.

Common Pitfalls in ABM Expansion

Even well-intentioned ABM expansion efforts can falter due to predictable mistakes that undermine campaign effectiveness and ROI. Understanding these pitfalls helps teams avoid costly missteps and build more resilient expansion programs.

The most common mistake is treating ABM expansion like traditional email marketing. Blasting existing customers with generic upsell offers and hoping for responses. This approach ignores the fundamental premise of account-based marketing: each account requires individualized strategy and messaging. Generic campaigns may actually damage relationships by suggesting you don’t understand their specific needs or priorities.

Another frequent error is focusing exclusively on existing contacts within target accounts. True expansion requires identifying and engaging new stakeholders who weren’t involved in the original purchase decision. This means investing in contact discovery, stakeholder mapping, and relationship building beyond your current sphere of influence within each account.

Poor sales and marketing alignment can sabotage even well-designed ABM expansion campaigns. When marketing generates engagement from new stakeholders but sales isn’t prepared to have expansion conversations, opportunities evaporate. Successful programs ensure sales teams understand the expansion strategy, have appropriate messaging for different stakeholder types, and can seamlessly continue conversations initiated by marketing campaigns.

“The biggest ABM expansion failures happen when teams try to scale personalization without proper systems and processes. Technology should enable human insights, not replace them.”

Frequently Asked Questions About ABM Expansion

How is ABM expansion different from traditional upselling?

Traditional upselling typically involves product-focused outreach to existing contacts, while ABM expansion treats existing customers like high-value prospects deserving personalized, multi-stakeholder campaigns. ABM expansion identifies new decision-makers, maps organizational needs, and creates coordinated touchpoints across multiple channels to drive larger, more strategic expansion opportunities.

What account criteria should guide ABM expansion prioritization?

Prioritize accounts based on expansion potential (contract size, available departments, growth indicators), engagement signals (usage patterns, support interactions, renewal likelihood), and relationship strength (stakeholder access, executive relationships, advocacy potential). Accounts scoring high across all three dimensions deserve your most intensive ABM treatment.

How long should ABM expansion campaigns run before optimization?

B2B expansion cycles typically require 3-6 months to generate meaningful engagement data and 6-12 months to produce reliable revenue attribution. However, adjust messaging and tactics based on engagement metrics monthly, and conduct comprehensive campaign reviews quarterly to optimize approach and resource allocation.

Can small teams execute effective ABM expansion programs?

Absolutely. Start with 1-to-Many ABM approaches that leverage marketing automation and programmatic personalization. Focus on your highest-potential accounts first, use dynamic content to scale personalization, and gradually expand as you prove ROI and secure additional resources for more intensive 1-to-Few or 1-to-1 programs.

What role does customer success play in ABM expansion?

Customer success teams provide critical account intelligence about usage patterns, satisfaction levels, and organizational changes that signal expansion opportunities. They should collaborate closely with marketing and sales to identify expansion signals, provide stakeholder introductions, and ensure expansion efforts enhance rather than complicate the customer relationship.

Transforming Customer Growth Through Strategic ABM Expansion

The companies winning in 2025 aren’t just acquiring more customers. They’re extracting dramatically more value from the customers they already have. ABM expansion represents a fundamental shift from transactional upselling to strategic account development, treating your best customers with the same systematic approach you’d use for your most important prospects.

The data supports this transformation. When executed properly, ABM expansion strategies don’t just increase deal size. They strengthen customer relationships, improve retention, and create sustainable competitive advantages that compound over time.

Success requires moving beyond intuition toward systematic, data-driven expansion strategies. This means investing in proper account intelligence, stakeholder mapping, coordinated campaign execution, and sophisticated attribution measurement. It also means aligning your entire revenue organization around expansion goals, not just acquisition metrics.

The opportunity cost of ignoring ABM expansion continues growing as acquisition costs rise and competitive pressure intensifies. Your existing customers represent known quantities with established trust relationships and predictable buying behavior. They’re quite literally your most valuable prospects.

Ready to transform your customer growth strategy? The teams seeing 171% ACV increases aren’t using magic. They’re using systematic ABM expansion frameworks that treat existing customers like the high-value prospects they actually are.

Ready to unlock that 171% revenue growth sitting inside your existing accounts?

The post 3 Proven ABM Expansion Tactics to Grow Customer Revenue appeared first on Single Grain.